Superannuation

As an RDA member, you can join the superannuation scheme.

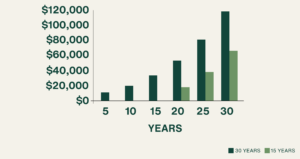

The Cost of Delay

Before you think, ‘I’m too young for superannuation’ or ‘I need to pay off my huge debt first’, think again. Below is a graph that shows the benefits of starting contributions early. Essentially, if you wait, you’ll never catch up.

Member 1 – $100 per month for 30 years with a 6% net return, including a 2% CPI increase.

Member 2 – $200 per month for 15 years with a 6% net return, including a 2% CPI increase.

Assumption: Although both members contribute the same total amount, the effect of time nearly doubles the return for Member 1.

RMOs are among the very few health sector employees who receive a 6% employer superannuation contribution, thanks to NZRDA’s negotiations on our members’ behalf.

The RDA offers a flexible scheme, allowing us to suspend contributions for up to 2 years (or longer by agreement), which can be helpful if, for example, you need to go overseas. For more information on the scheme, please email superannuation@nzrda.org.nz.

However, it’s not the only option. There’s also Kiwisaver, MAS, and other schemes available, so be sure to seek independent financial advice before making your decision. Remember, if you wish to opt out of Kiwisaver, you must do so within the first 50 days of employment by law.

Advantages

While anyone can contribute to a superannuation scheme, our Collective Agreement ensures the employer will match your contributions up to 6% of your income.

The funds are not locked in and are accessible when you leave your employment with Te Whatu Ora.

If you’ve previously been a member of the NZRDA but have since left, you can still rejoin our superannuation scheme.

Resources

FAQs

-

These are paid from the funds, or the underlying funds the funds may invest in. These vary between funds, as some require more active management than others (you can see estimates of these charges on page 9 of the LifeSaver Plan Product Disclosure Statement). They are made up of:

- Management fees charged by Fisher Funds for providing investment management services to the funds.

- Expenses incurred by the funds such as accounting and investment transaction fees.

-

These are set out in the NZRDA supplement.

- Administration Fees of $6 per member per month or $2,000 per annum (spread across all NZRDA members of LifeSaver), whichever is the greater.

- Legal, audit and registry services fees, all wrapped up together and applied to all members on a pro-rata basis. These vary depending on the fund and are set out in your transaction history.

- Supervisor Fee of $3,500 is spread across all members of LifeSaver, and amounts to a modest annual charge (currently around $1.20 per member per annum). The Supervisor fee is deducted quarterly from your employer account and will vary from time to time depending on the number of members in the fund.

-

There are currently no establishment, termination, or withdrawal fees charged.

-

Sarah, a hypothetical member, invests $10,000 in the Balanced Fund. The starting value of her investment is $10,000. She is charged management and administration fees, which work out to about $108.00 (1.08% of $10,000). These fees might be more or less if her account balance has increased or decreased over the year. Over the next year, Sarah may pay other charges of $97.76 made up from the administration fee, the legal, audit and registry service fees, and the supervisor fee.

-

Under the NZRDA Plan, your employer will give you a $-for-$ subsidy of up to 6% of your pay. This is the Employer Contribution, however, if you are a member of KiwiSaver, and wish to continue contributing to KiwiSaver, your employer will split the 6% Employer Contribution between the NZRDA Plan and KiwiSaver (3% each).

-

This is anything you wish to contribute over and above what is required.

-

This is the percentage that you are required to contribute. If you are contributing to KiwiSaver, then you can contribute 3% to the NZRDA Plan and this will be matched by your employer. If you are not contributing to KiwiSaver, then your Investor Contribution can be up to 6%.

-

You are able to make lump sum contributions once your account is open, via internet banking. These contributions are added to your Voluntary Account.

-

Yes, you can join the NZRDA Member Superannuation Scheme (LifeSaver) and KiwiSaver, for example. In this case, both employer and member are required to contribute 6% and this can be split between LifeSaver and KiwiSaver (eg 3% LifeSaver and 3% KiwiSaver). Please note that all employer contributions are subject to ESCT.

ESCT stands for Employer Superannuation Contribution Tax and is deducted from your employer’s contributions to your superannuation. You can read more about this on IRD’s website IRD – Employer Superannuation Contribution Tax.

-

While your employer will split contributions between KiwiSaver and another superannuation scheme, such as the NZRDA Scheme, they will not contribute to two schemes outside of KiwiSaver.

-

Then your employer is required to contribute 6% (less ESCT) to the scheme of your choice, for example, the NZRDA Scheme. ESCT stands for Employer Superannuation Contribution Tax and is deducted from your employer’s contributions to your superannuation. You can read more about this on IRD’s website IRD – Employer Superannuation Contribution Tax.

-

ESCT stands for Employer Superannuation Contribution Tax and is deducted from your employer’s contributions to your superannuation. You can read more about this on IRD’s website IRD – Employer Superannuation Contribution Tax.