Superannuation

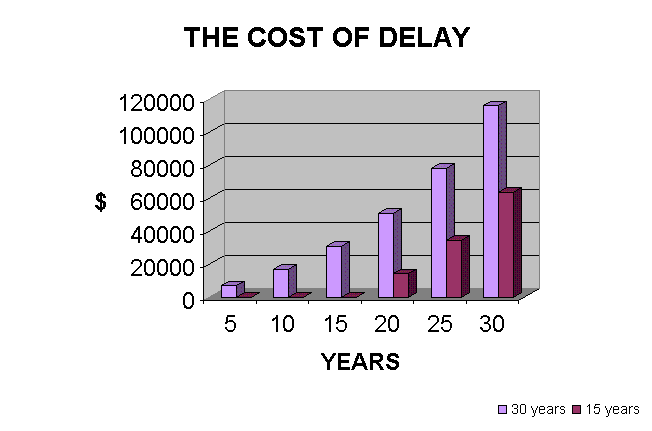

As an RDA member, you can join the superannuation scheme. Before you think, “I’m too young for superannuation” or “with my huge debt I need to pay that off first” think again. Below is a graph, which demonstrates the benefits of early commencement of contributions. Essentially if you leave it, you never catch up.

Member 1 – $100 per month for 30 years with a return of 6% (net) – includes a 2% CPI increase

Member 2 – $200 per month for 15 years with a return of 6% (net) – includes a 2% CPI increase

Assumption: Although both members invest the same total contribution the effects of time almost doubled the return for Member 1.

RMOs are amongst the very few health sector employees to have 6% employer superannuation contributions available – courtesy of NZRDA’s negotiations on our member’s behalf we unashamedly cry!

The RDA has a scheme that is flexible, for example allows us to suspend contributions for up to 2 years (and longer by agreement) in case we need to go overseas for instance. If you want more information on the scheme, please email superannuation@nzrda.org.nz.

It is not the only scheme, however. There is Kiwisaver, and MAS has a scheme, amongst others, so seek some independent financial advice before starting employment. Remember if you wish to “opt out” of Kiwisaver, you have to do so (at law) within the first 50 days of employment.

The advantages of your superannuation scheme

Whilst anyone can start contributing to a superannuation scheme, our SECA provides for the employer to contribute equally to your scheme up to 6% of your income. Before you say, “I’m too young for superannuation” or “I need to pay off my debt first”, think again. The benefits of commencing contributions early are well established: if you delay, you can never catch up.

Flexible, transportable, matched contributions

RMOs are amongst the very few health sector employees to have superannuation available – courtesy of NZRDA’s negotiations on our members’ behalf. We can also suspend contributions for up to 2 years (and longer by agreement) – in case you need to go overseas, for example. Funds are not locked in, and are available to you upon ceasing your employment with Te Whatu Ora.

The employer match your contribution up to 6% a year. Past and present NZRDA members can join our superannuation scheme.

Superannuation Forms

Superannuation FAQs

These are paid from the funds, or the underlying funds the funds may invest in. These vary between funds as some require more active management than others (you can see estimates of these charges on page 9 of the LifeSaver Plan Product Disclosure Statement). They are made up of 1) the Management fee charged by Fisher Funds for providing investment management services to the funds, and 2) the Expenses incurred by the funds such as accounting and investment transaction fees.

There is an Administration Fees of $6 per member per month or $2,000 per annum (spread across all NZRDA members of LifeSaver), whichever is the greater. Administration fees are currently $6.00 per member per month.

There are Legal, audit and registry services fees, all wrapped up together and applied to all members on a pro-rata basis. These vary depending on the fund and are set out in your transaction history.

The Supervisor Fee of $3,500 is spread across all members of LifeSaver and amounts to a modest annual charge (currently around $1.20 per member per annum). The Supervisor fee is deducted quarterly from your employer account and will vary from time to time depending on the number of members in the fund.

There are currently no establishment, termination, or withdrawal fees charged.

Under the NZRDA Plan, your employer will give you a $-for-$ subsidy up to 6% of your pay. This is the Employer Contribution. However, if you are a member of KiwiSaver, and wish to continue contributing to KiwiSaver, your employer will split the 6% Employer Contribution between the NZRDA Plan and KiwiSaver (3% each).

This is anything you wish to contribute over and above what is required.

This is the percentage that you are required to contribute. If you are contributing to KiwiSaver, then you can contribute 3% to the NZRDA Plan and this will be matched by your employer. If you are not contributing to KiwiSaver, then your Investor Contribution can be up to 6%.

You are able to make lump sum contributions once your account is open, via internet banking. These contributions are added to your Voluntary Account.

Yes, you can join the NZRDA Member Superannuation Scheme (LifeSaver) and KiwiSaver, for example. In this case, both employer and member are required to contribute 6% and this can be split between LifeSaver and KiwiSaver (eg 3% LifeSaver and 3% KiwiSaver). Please note that all employer contributions are subject to ESCT. ESCT stands for Employer Superannuation Contribution Tax and is deducted from your employer’s contributions to your superannuation. You can read more about this on IRD’s website IRD – Employer Superannuation Contribution Tax.

While your employer will split contributions between KiwiSaver and another superannuation scheme, such as the NZRDA Scheme, they will not contribute to two schemes outside of KiwiSaver.

Then your employer is required to contribute 6% (less ESCT) to the scheme of your choice, for example, the NZRDA Scheme. ESCT stands for Employer Superannuation Contribution Tax and is deducted from your employer’s contributions to your superannuation. You can read more about this on IRD’s website IRD – Employer Superannuation Contribution Tax.

ESCT stands for Employer Superannuation Contribution Tax and is deducted from your employer’s contributions to your superannuation. You can read more about this on IRD’s website IRD – Employer Superannuation Contribution Tax.

Want to know more?

If you want more information on the scheme, please contact the office ask@nzrda.org.nz and we will provide all the information to you.