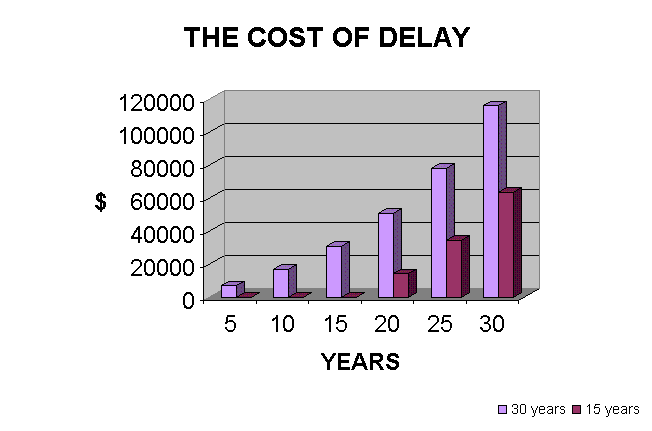

As an RDA member, you can join the superannuation scheme. Before you think, “I’m too young for superannuation” or “with my huge debt I need to pay that off first” think again. Below is a graph, which demonstrates the benefits of early commencement of contributions. Essentially if you leave it, you never catch up.

Member 1 – $100 per month for 30 years with a return of 6% (net) – includes a 2% CPI increase

Member 2 – $200 per month for 15 years with a return of 6% (net) – includes a 2% CPI increase

Assumption: Although both members invest the same total contribution the effects of time almost doubled the return for Member 1.

RMOs are amongst the very few health sector employees to have 6% employer superannuation contributions available – courtesy of NZRDA’s negotiations on our member’s behalf we unashamedly cry!!

The RDA has a scheme that is transportable, allows us to suspend contributions for up to 2 years (and longer by agreement) in case we need to go overseas for instance. If you want more information on the scheme, please email superannuation@nzrda.org.nz.

It is not the only scheme, however. There is Kiwisaver, and MAS has a scheme, amongst others, so seek some independent financial advice before starting employment. Remember if you wish to “opt out” of Kiwisaver, you have to do so (at law) within the first 50 days of employment.